AGNC Investment Corp. is an internally-managed real estate investment trust that invests predominantly in agency mortgage-backed securities on a leveraged basis, financed primarily through collateralized borrowings structured as repurchase agreements. AGNC makes money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference.

I bought into AGNC for income as they provide monthly dividends. But, recently, I have been increasing my position on JEPI 0.00%↑ and QYLD 0.00%↑ (combined by 33% of the portfolio and 70% of dividends), I am trying to reduce my income positions and increase more long-term dividend growth stocks. So, I exited out of AGNC 0.00%↑.

Overview

📈 Increase in cashflow

🔴 Risks with AGNC 0.00%↑

♻️ Substitution

📈 Increase in cashflow

AGNC 0.00%↑ always had risks associated with it. My main reason for AGNC purchase was for monthly dividends at 10%. I have been able to collect $1,166.59 in dividends. I invested around $14,325.22 and sold it at $13,608.96 with about a 5% loss. I was in 3.14% net profit i.e. $449.81.

I recently started exploring income (covered call) ETFs to replace my “income“ stocks. I initially invested in QYLD 0.00%↑, NUSI 0.00%↑, JEPI 0.00%↑ , BST 0.00%↑ , and RYLD 0.00%↑. Based on income and downwards protection, I could concentrate on two QYLD 0.00%↑ and JEPI 0.00%↑ in a 60-40 ratio that yields at 10%+ monthly dividends. The portfolio can be seen here.

Since I was able to substitute my income from AGNC with QYLD and JEPI - with lower risk, I decided to exit AGNC.

🔴 Risks with AGNC 0.00%↑

There are few risks associated with AGNC. If you haven’t bought it at a discounted price (like $9 or below), chances are you could lose money. Here are a few risks associated with AGNC.

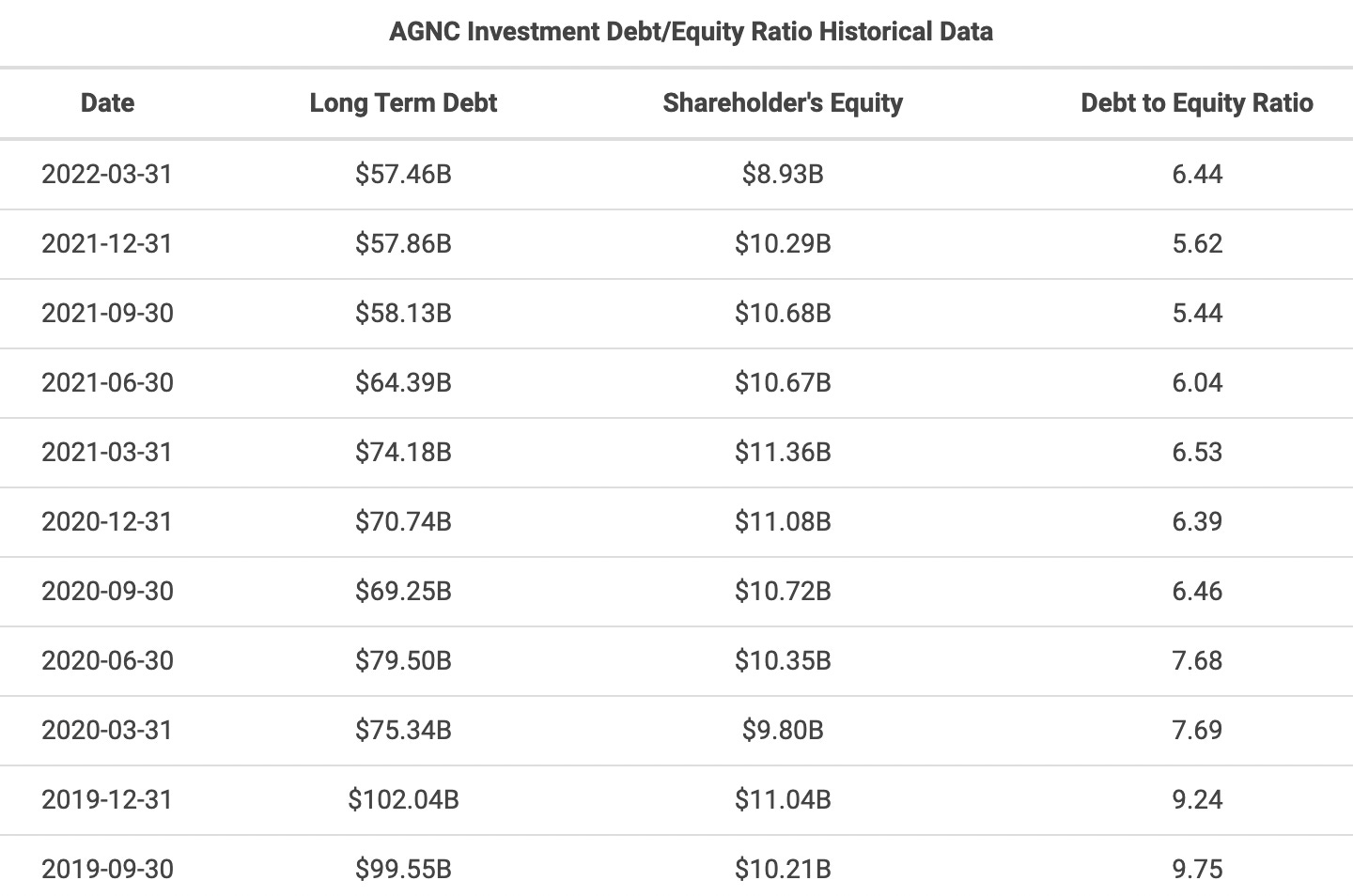

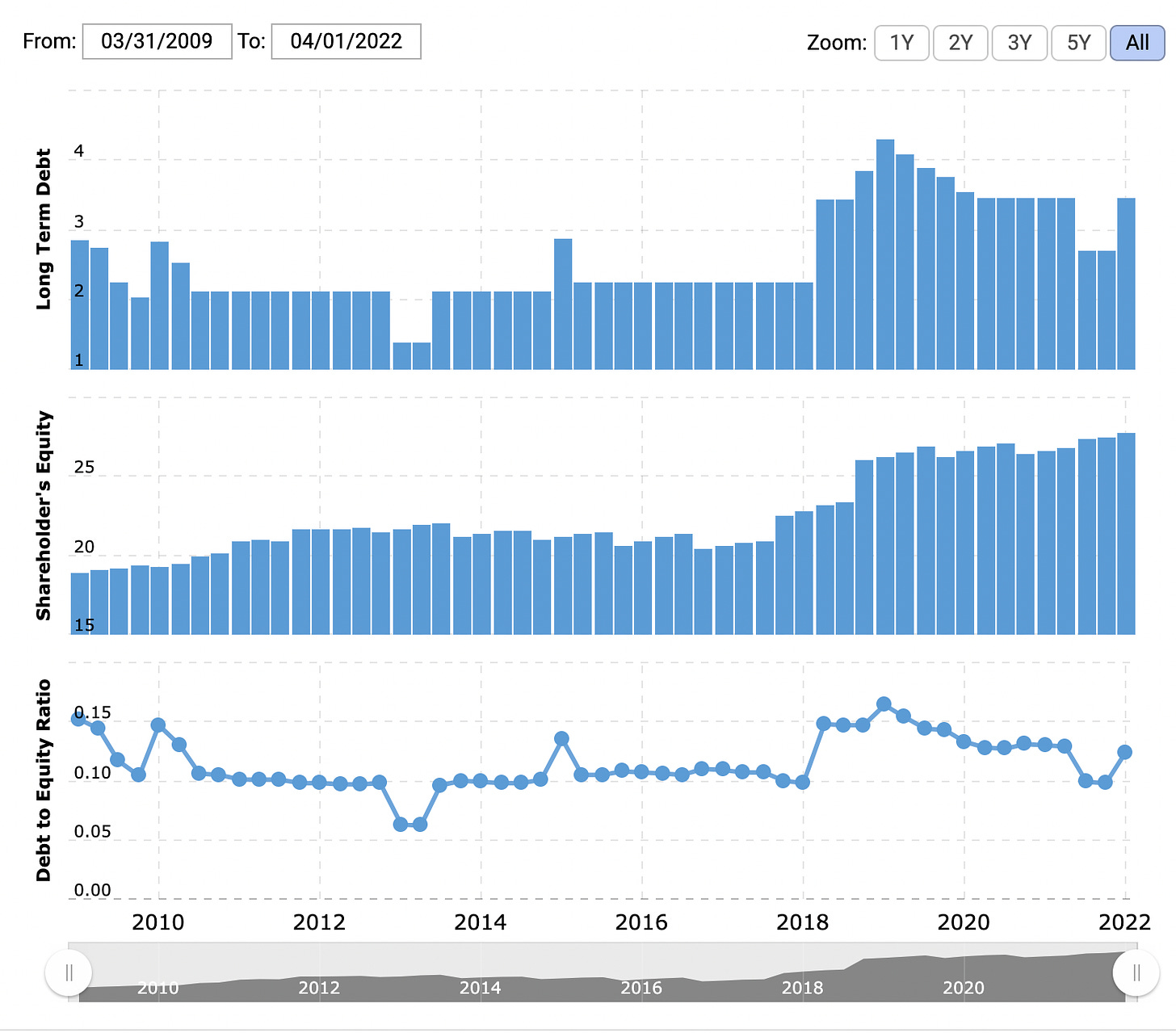

🏦 Highly leveraged: To amplify returns AGNC is highly leveraged. And, debt has been increasing more and more. While REITs generally have a high debt-to-equity ratio, the industry-wide average is 3.5.

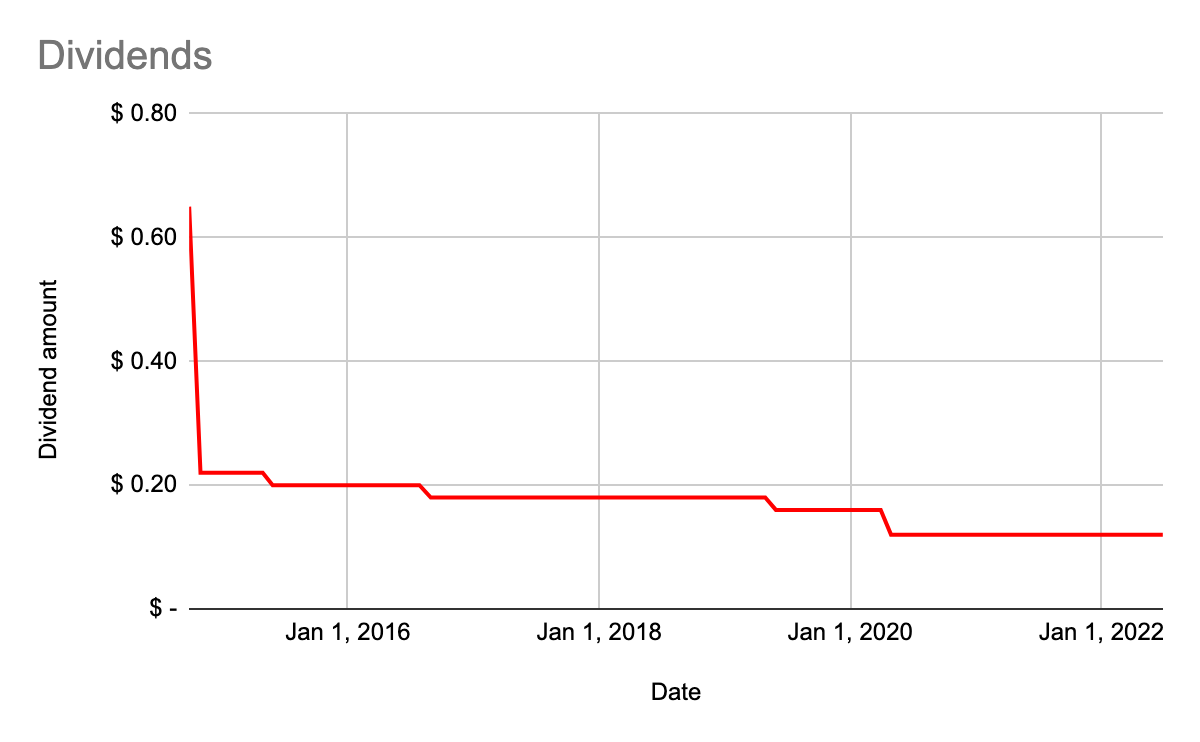

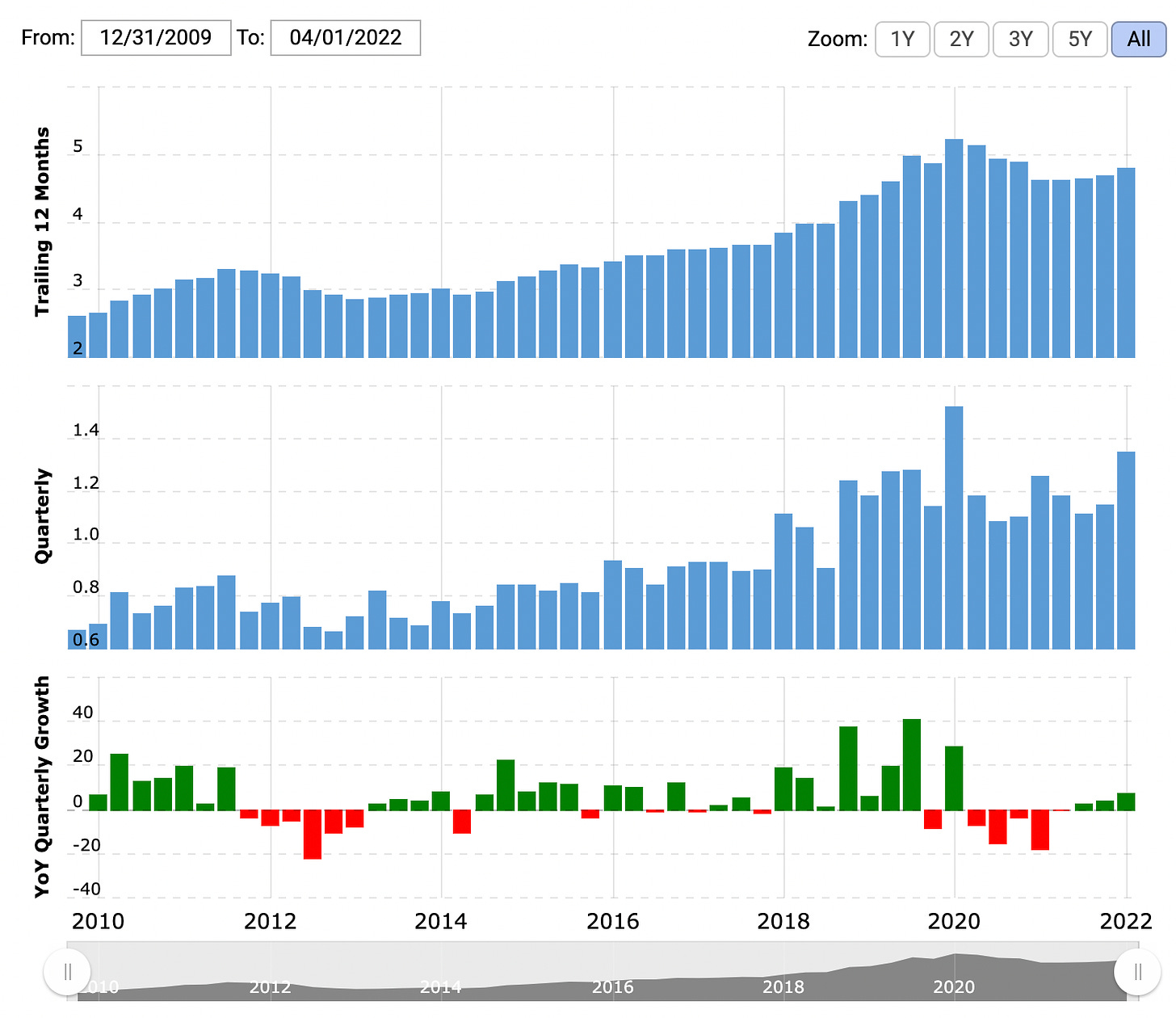

🥲 Reducing dividends: While the dividend yield is increasing, the dividend amount itself has been decreasing. It is the result of deteriorating financials like revenue.

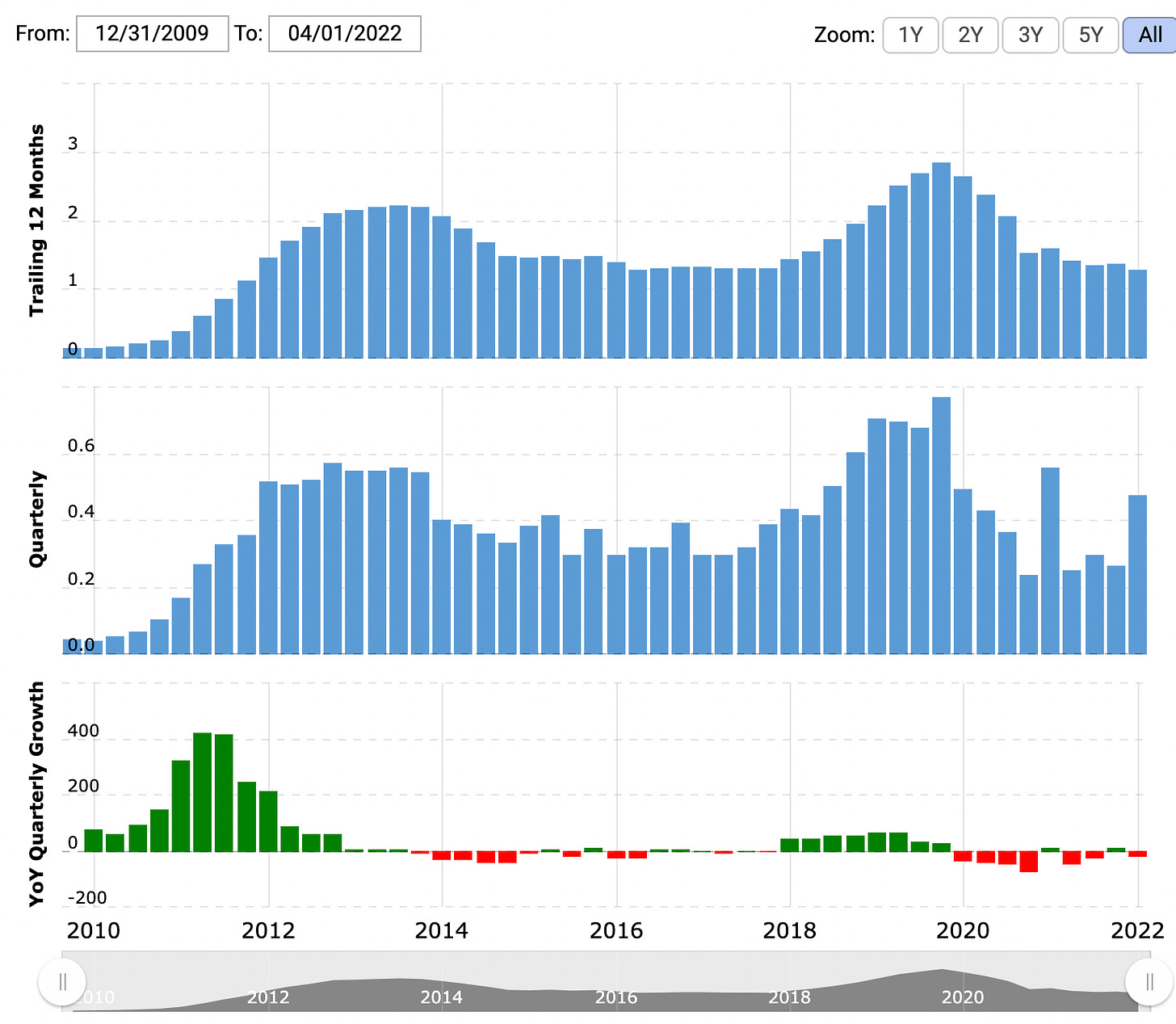

🤢 Deteroiting financials: In a rising interest rate environment, mortgage REITs typically see the value of their investments reduced. Its revenue and net profit have been decreasing, as a result, it has an unsustainable payout ratio

♻️ Substitution

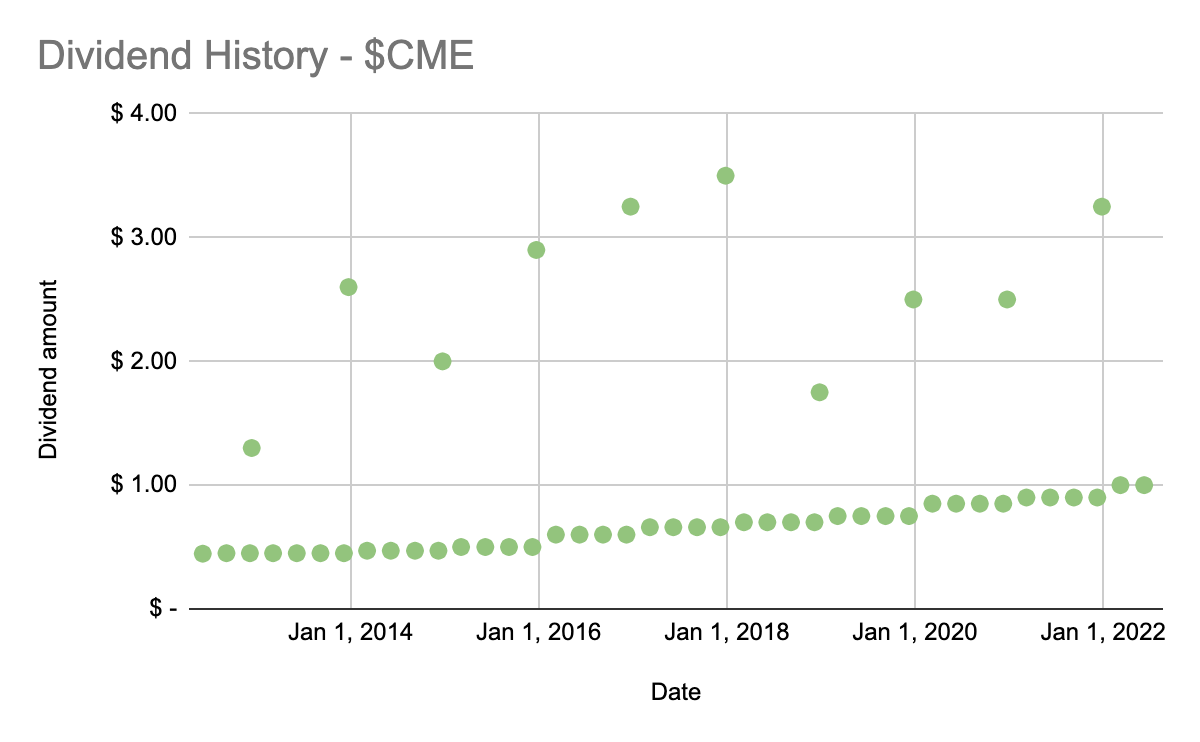

Now that JEPI and QYLD fill my income stock quota, I can use my money from the AGNC trade to buy a quality company that is opposite of AGNC, a strong financial company with a good dividend CAGR. I have decided to initiate a position in CME 0.00%↑. It is a financial derivatives exchange, and trades in asset classes that include agricultural products, currencies, energy, interest rates, metals, stock indexes, and cryptocurrencies futures. Here are a few KPIs of CME:

👑 Dividends: CME has a 3-year dividend CAGR of 9.43% and has increased its dividends for 18 consecutive years. They are also famously known for their special dividends.

📈 Increasing revenue: CME has been increasing its revenue by 7%+ YoY.

🏦 Low leverage: CME has been decreasing its debt to equity ratio. It stands at 0.12, industry average is around 1.

The takeaway from this post:

It’s never too late to fall into the dividend trap

Invest in a quality company