Hello everyone!

Today, I’m diving into ASML’s Q4 & FY 2024 earnings report—one of my favorite companies in the semiconductor space. For those unfamiliar, ASML is the world’s leading supplier of photolithography machines used in semiconductor manufacturing, critical for producing the most advanced chips powering AI, smartphones, and data centers.

How I Got Started with ASML

I first came across ASML thanks to Invesquotes, one of the best voices to follow for ASML insights. He runs Best Anchor Stocks, which offers deep dives into high-quality companies. I urge you to subscribe to his substack.

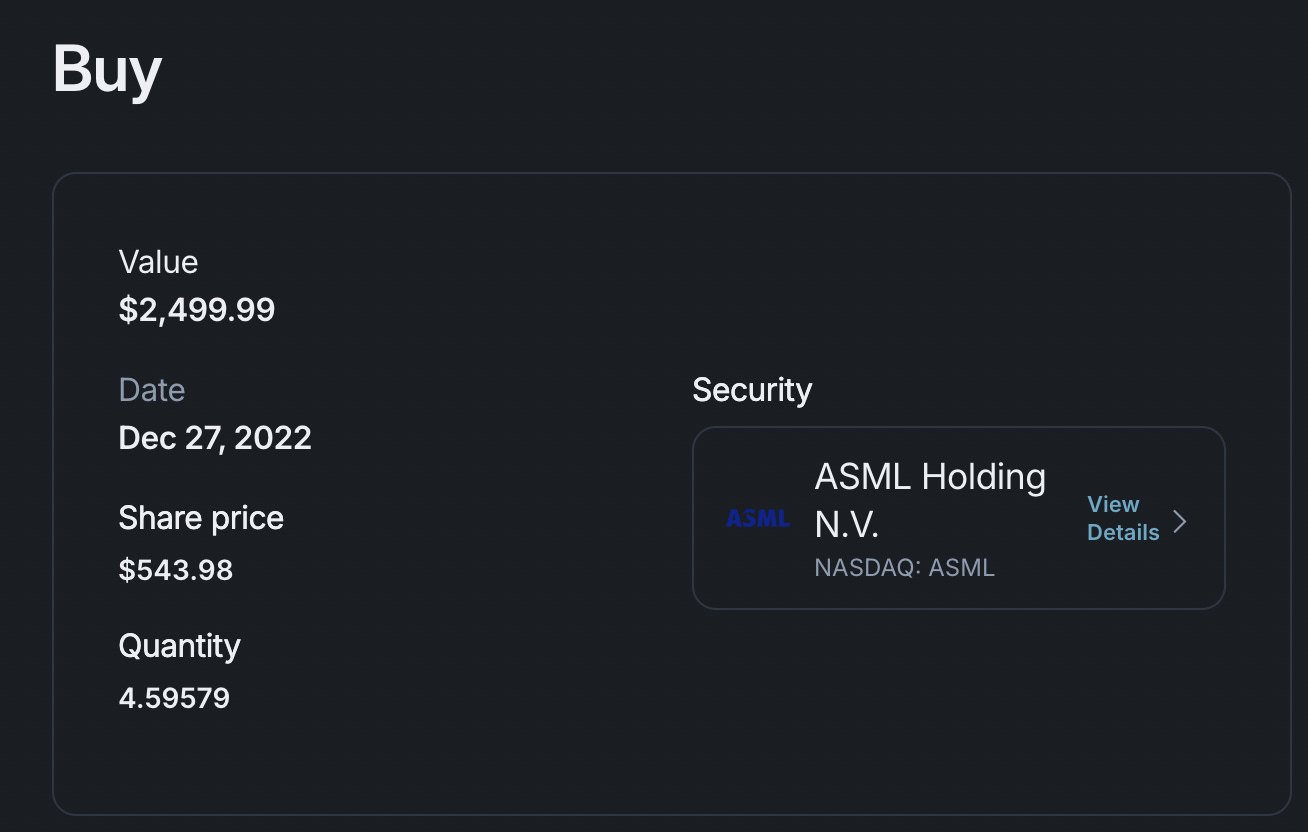

I made my first ASML purchase on December 27, 2022, and since then, I've built a position with an average cost of €652.00. As of today, I’m sitting on a 12.5% gain overall. This has been one of my most rewarding investments, and here’s why I remain bullish.

📊 ASML FY 2024 Earnings Highlights

ASML delivered an impressive performance for FY 2024, showcasing resilience and growth despite a challenging macroeconomic environment and global semiconductor headwinds. Here are the key highlights:

💸 Revenue: €28.3 billion, reflecting steady growth driven by robust demand for both EUV (Extreme Ultraviolet) and DUV (Deep Ultraviolet) lithography systems. The growth was supported by AI-driven semiconductor demand and continued expansion in advanced chip production.

📈 Net Income: €7.6 billion, indicating strong profitability, backed by operational efficiencies and a favorable product mix.

💵 EPS (Earnings Per Share): €19.25, demonstrating solid earnings growth and efficient capital management.

📊 Q4 2024 Revenue: €9.26 billion, surpassing analyst expectations and showcasing a strong finish to the fiscal year. This beat was largely due to higher-than-expected system sales and service revenue.

📝 Net Bookings: €7.09 billion in Q4, marking a staggering 169% QoQ growth. This surge highlights continued strong demand for ASML’s advanced lithography systems, with EUV machines contributing approximately €3 billion in new orders.

💰 Free Cash Flow: €8.8 billion in Q4, reflecting ASML’s strong cash generation capabilities, fueled by operational efficiency and high-margin product sales.

📦 Backlog: ASML’s order backlog remains robust at €36 billion, providing strong revenue visibility for the coming years.

Key Drivers of Growth:

EUV Demand: The AI chip boom and high-bandwidth memory (HBM) technologies are major growth drivers. ASML’s cutting-edge EUV systems are critical for producing advanced semiconductors used in AI, 5G, and autonomous technologies.

Service Business Expansion: Installed Base Management (IBM) revenue showed strong growth, benefiting from the expanding global footprint of ASML machines and increasing demand for maintenance and upgrades.

Operational Excellence: Gross margins remained strong at 51.7%, supported by cost discipline, operational efficiencies, and an improved product mix favoring higher-margin EUV tools.

Geopolitical Resilience: Despite export restrictions and geopolitical tensions, particularly with China, ASML navigated these challenges effectively, maintaining strong demand across key markets.

ASML’s FY 2024 performance reaffirms its leadership in the semiconductor equipment space, powered by innovation, strategic execution, and a growing role in the AI-driven technological revolution.

💰 Dividends & Share Buybacks: A Growing Story

ASML isn’t just about growth—it’s also rewarding shareholders handsomely:

Dividend Growth: ASML declared a total dividend of €7.05 per share for FY 2024, reflecting a strong increase from previous years. The dividend has been consistently growing, backed by solid free cash flow.

Share Buybacks: ASML returned over €3 billion to shareholders through dividends and share repurchases in 2024. The ongoing buyback program reduces the share count, enhancing per-share metrics.

This shareholder-friendly approach, combined with strong earnings, makes ASML a rare blend of growth and income.

🔮 Future Outlook

ASML’s future looks bright, driven by several key trends:

AI & High-Performance Chips: The AI boom is fueling demand for ASML’s EUV tools, essential for cutting-edge semiconductors.

2025 Guidance: Revenue projected between €30B and €35B, driven by continued EUV/DUV strength.

China Exposure: Sales are normalizing after two years of backlog-driven growth, with China expected to contribute around 20% of sales.

2026 & Beyond: ASML anticipates another growth phase fueled by High-NA EUV adoption, AI chip expansion, and increasing semiconductor demand.

Despite geopolitical uncertainties, ASML’s dominant position, strong order book, and strategic role in AI infrastructure make it a compelling long-term investment.

🚀 Final Take

ASML continues to deliver on all fronts—earnings growth, dividends, buybacks, and future potential. While volatility may arise, I’m holding strong with confidence in ASML’s long-term growth trajectory.

Are you bullish on ASML? Let’s discuss below! 💬🚀