Let's talk about Dividend Taxes | #52

Understanding U.S. Dividend Taxes & Strategies to Minimize Your Tax Bill

Hey everyone!

Today, we’re diving into dividend taxes and how to make sure you’re not giving away more than you need to. One of the biggest arguments against dividend growth investing is double taxation, especially compared to capital gains or growth-focused strategies. In this newsletter, I’ll try to break down how dividends are taxed, the latest tax rates, and smart ways to optimize your dividend strategy so you can keep more of what you earn. Let’s get into it! 🚀

💰 How Dividends Are Taxed in the U.S.

Dividends in are classified into two main types: qualified and ordinary (non-qualified). Since, both of them are taxed differently, understanding the difference is crucial because it directly affects how much tax you owe on your dividend income.

Qualified Dividends: These are dividends paid by U.S. corporations (or qualified foreign corporations) and must meet specific holding period requirements to qualify for lower tax rates, similar to long-term capital gains.

Ordinary (Non-Qualified) Dividends: These are dividends that do not meet the criteria to be considered "qualified" and are taxed as regular income at your marginal tax rate. So, generally, they are higher.

For example, let’s say you buy 100 shares of Apple ( AAPL 0.00%↑ ) at $170 per share, and Apple pays a $1 per share annual dividend. That means you’ll receive $100 in dividends over the year.

If you hold the stock for less than 61 days within the 121-day period surrounding the ex-dividend date, your dividend is considered ordinary (non-qualified) and taxed as regular income (e.g., if you’re in the 24% tax bracket, you’ll pay $24 in taxes on your $100 dividend).

If you hold the stock for at least 61 days within that same period, your dividend is qualified and taxed at the lower long-term capital gains rates (0%, 15%, or 20%, depending on your income). For most investors, that means paying only 15%—or $15 in taxes instead of $24.

Dividend Growth Investing is by nature encouraging investors to hold for longer periods of time - be it in terms of capital gain, dividend gains, compounding effects, or taxation.

💸 Current Dividend Tax Rates (2024-2025)

For qualified dividends, tax rates are as follows:

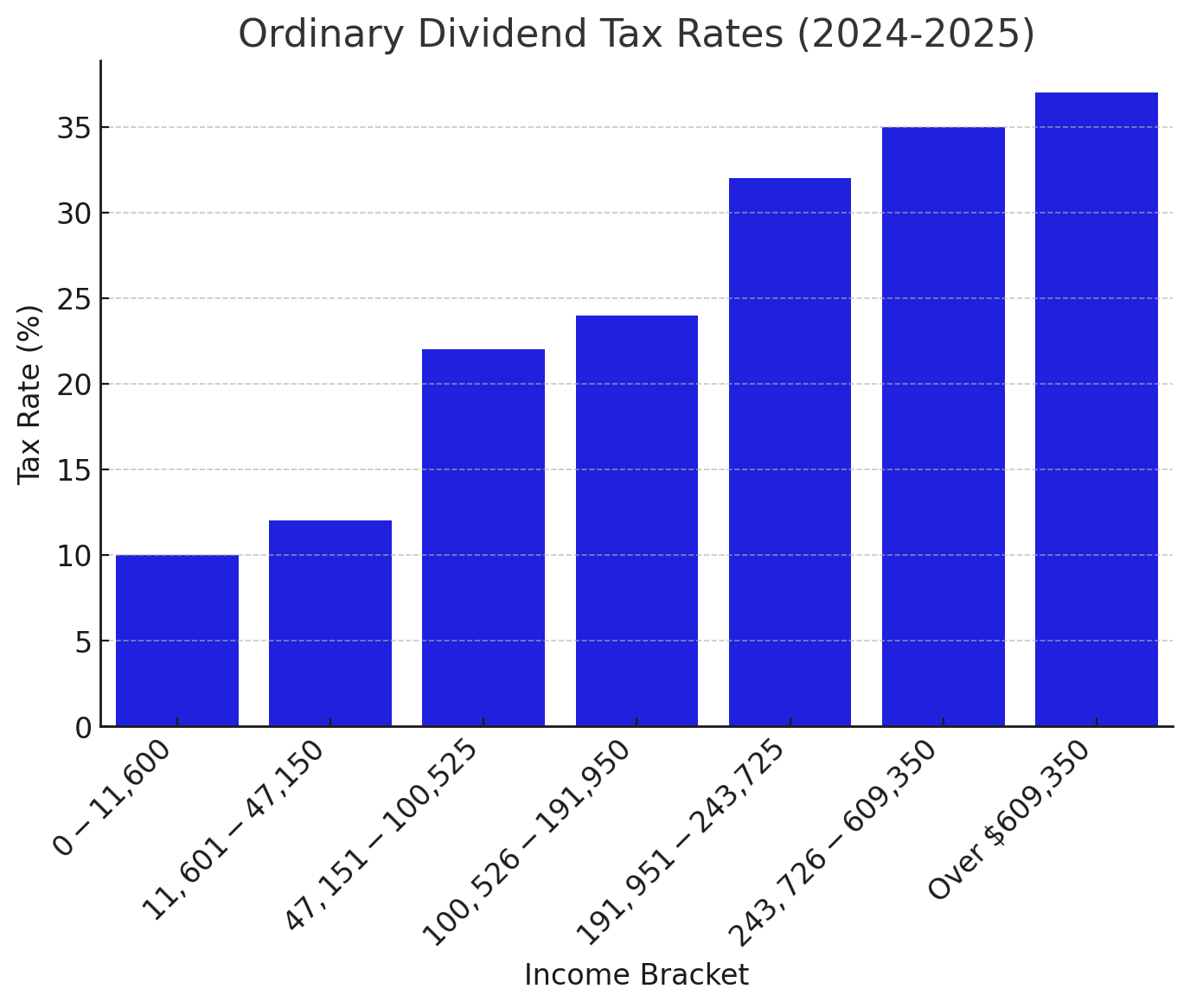

For ordinary (non-qualified) dividends, they are taxed as regular income at these rates:

🏡 State Taxes on Dividends

Apart from federal taxes, state-level taxes on dividends can vary. Some states, like Texas, Florida, and Nevada, have no state income tax, making them more tax-efficient for dividend investors. Others, like California and New York, have high state tax rates on dividend income.

💳 Tax-Efficient Dividend Investing Strategies

🏦 Holding Dividend Stocks in Tax-Advantaged Accounts

A powerful strategy to minimize dividend taxes is to hold dividend-paying investments in tax-advantaged accounts, such as:

Roth IRA: No taxes on withdrawals or dividends if held until retirement.

Traditional IRA/401(k): Taxes are deferred until withdrawal, potentially lowering tax impact.

Other Tax-Free Investment Options: Some countries offer tax-advantaged accounts similar to IRAs and 401(k)s, so check local tax laws.

📊 Dividend Growth Investing vs. High-Yield Stocks

The way dividends are taxed can also influence your choice between:

Dividend Growth Stocks (e.g., Visa, Microsoft, Apple): These stocks have lower yields but consistently grow dividends, making them tax-efficient in taxable accounts. So, holding them for longer period of time could be more tax beneficial.

High-Yield Stocks (e.g., REITs, MLPs): While attractive for income, these often have higher tax burdens because some distributions may be taxed as ordinary income like QYLD 0.00%↑ and JEPI 0.00%↑ .

🌿 Using ETFs for Lower Tax Drag

Dividend-focused ETFs can be a tax-efficient way to invest in dividends:

SCHD (Schwab U.S. Dividend Equity ETF): Holds qualified dividend stocks, making it tax-friendly.

VYM (Vanguard High Dividend Yield ETF): Focuses on dividend payers but still tax-efficient for long-term investors.

Pro tip: ETFs minimize taxable distributions through in-kind redemptions, making them a great option for taxable accounts.

🎯 Final Thoughts

Dividend taxation can eat into your returns, but smart planning can reduce your tax bill. Whether it's using tax-advantaged accounts, choosing tax-efficient investments, or strategically structuring your portfolio, optimizing for taxes can help maximize your income over time.

Happy Investing!