Hello everyone, today we have different topic, unlike focusing on growth of stock, we are focusing on a short thesis on a company.

The ad tech industry is no stranger to controversy, and recently, AppLovin ( APP 0.00%↑ ) has found itself at the center of two explosive short reports—one from FuzzyPanda Research and another from Culper Research. Both claim that AppLovin’s rapid growth is built on questionable practices, from ad fraud to unauthorized tracking. But how much of this is just short-seller noise, and how much is a real concern for investors? Let’s break it down.

What Are the Short Sellers Claiming?

FuzzyPanda’s Allegations:

AppLovin’s AI growth story is built on “Ad Fraud” – The report suggests that AppLovin’s supposed AI-driven ad technology (AXON 2.0) may actually rely on practices that mimic Meta’s advertising data.

Illegal tracking of children – They claim AppLovin is involved in serving ads to children, potentially violating COPPA regulations.

Sexually inappropriate ads being served to minors – If true, this could be a major regulatory issue.

Direct download model is AppLovin’s top revenue driver – They allege that AppLovin is involved in illicit "direct downloads," installing apps on users’ devices without clear consent.

Culper Research’s Allegations:

AppLovin’s AI hype is a smokescreen – According to them, AXON 2.0 is a ‘black box’ that investors blindly trust without understanding.

Manipulative ad installs – They claim AppLovin uses in-game ads that trigger silent app installations through deceptive UX design.

Ad placements in popular mobile games – AppLovin’s alleged direct downloads extend to major games like Subway Surfers, 8 Ball Pool, and Angry Birds.

Massive ad fraud at scale – They believe AppLovin secretly integrates ad fraud mechanisms to artificially inflate installs and revenues.

My Thoughts

I’ve been following AppLovin closely and discussing these concerns with other investors and industry insiders. Here’s my take:

1. Black Box Issue

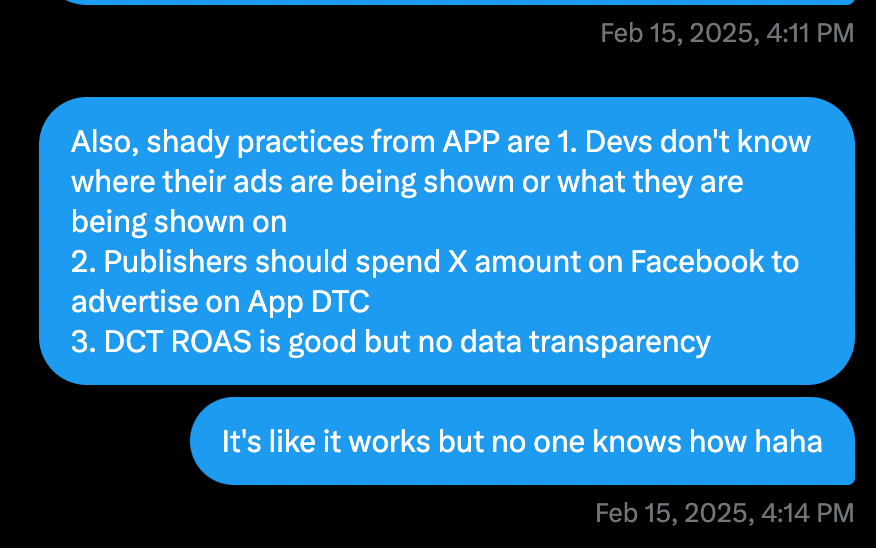

It’s well known that AppLovin operates as a “black box” in many ways. Developers and advertisers often don’t have clear visibility into:

Where their ads are being displayed.

What kind of content their ads are appearing on.

Why AppLovin’s ad network outperforms others in terms of installs.

Without access to AppLovin’s bidding reports, it’s difficult to say with certainty whether their ad performance is organic or manipulated. This lack of transparency raises valid concerns but isn’t necessarily proof of fraud.

2. Copying Meta’s Homework?

One of the biggest claims is that AppLovin’s success is due to replicating Meta’s advertising strategies—potentially through unauthorized data access. While this sounds concerning, there’s currently no definitive proof. Also, it’s worth noting that many mobile ad networks operate with similar methodologies, leveraging user data for better targeting.

3. Common (and Questionable) Industry Practices

Some of the allegations—like deceptive UX tricks and aggressive data collection—are unfortunately widespread in the mobile gaming industry. Examples include:

Fake countdown timers to trick users into clicking on ads.

Auto-redirecting app installs disguised as legitimate promotions.

Forcing multiple “X” outs before a user can close an ad.

While unethical, these practices aren’t exclusive to AppLovin. If regulators crack down on these methods, it could impact the entire industry, not just AppLovin.

Does This Change My View on AppLovin?

While the reports highlight some concerning but not necessarily new issues within the mobile advertising space. The lack of hard data and transparency makes it difficult to validate all the claims. I have posted the screenshot of the conversation I recently had with my friends regarding why I feel it as a scamy company.

However, a few things could pose real risks to AppLovin:

Serving ads to children – If proven, this could lead to significant legal and regulatory action.

Reputation damage from coordinated short attacks – Regardless of whether the claims are fully accurate, the sheer volume of negative press could impact AppLovin’s partnerships and stock performance.

Ultimately, AppLovin remains a dominant force in mobile advertising. While I know the risks, these short reports haven’t provided enough concrete evidence to significantly change my stance on the company - I am still confused why it works so good.

What do you feel about the short report by these companies?