July 2022 update! 📆 | #20

Monthly update on capital gains, dividends, and other life events

Between $25k in gains, buying a social media company, and the second highest dividend income, July was a heck of a ride.

This month covers the following:

Overview

🤑 Dividends update

🥧 Portfolio update

🍳 Private Equity update

🛫 Life events

🤑 Dividends update

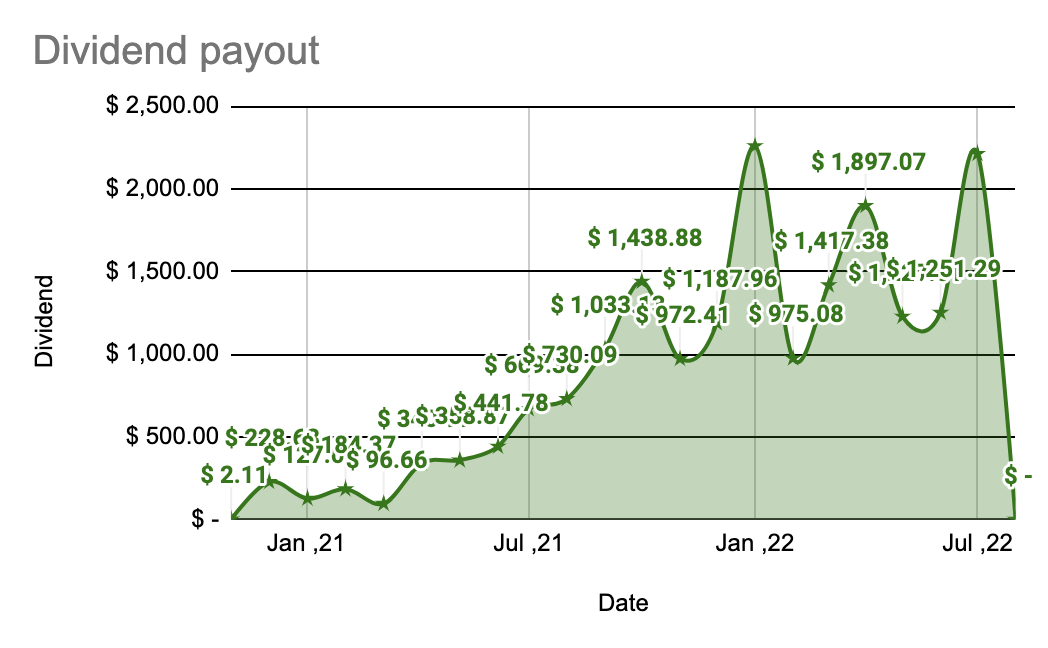

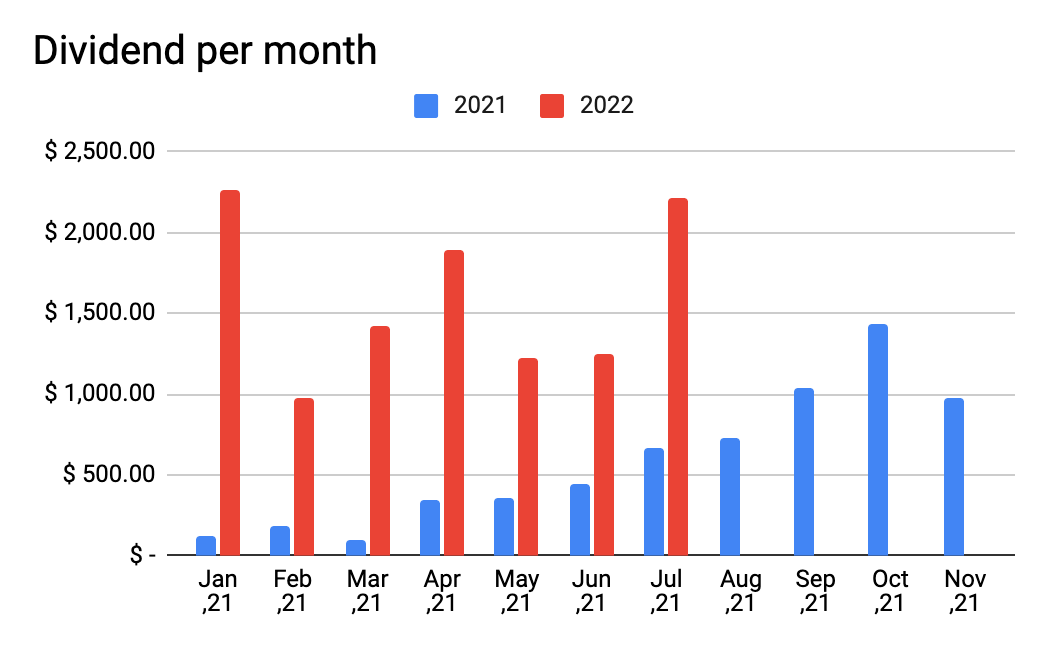

This month I received the second highest dividend income ever with $2,211.38 only behind $2,258.00 Jan 2022. I was expecting to make around $1.5k.

I got a total of 8 cheques from VICI 0.00%↑ ($ 273.66), JEPI 0.00%↑ ($482.27), AGNC 0.00%↑ ($135.08), O 0.00%↑ ($89.90), QYLD 0.00%↑ ($427.19), NRZ 0.00%↑ ($440.39), BST 0.00%↑ ($230.86), and JPM 0.00%↑ ($132.03). Next month I am expecting to make $1,155.43.

This is what my YoY dividends chart looks like:

🥧 Portfolio update

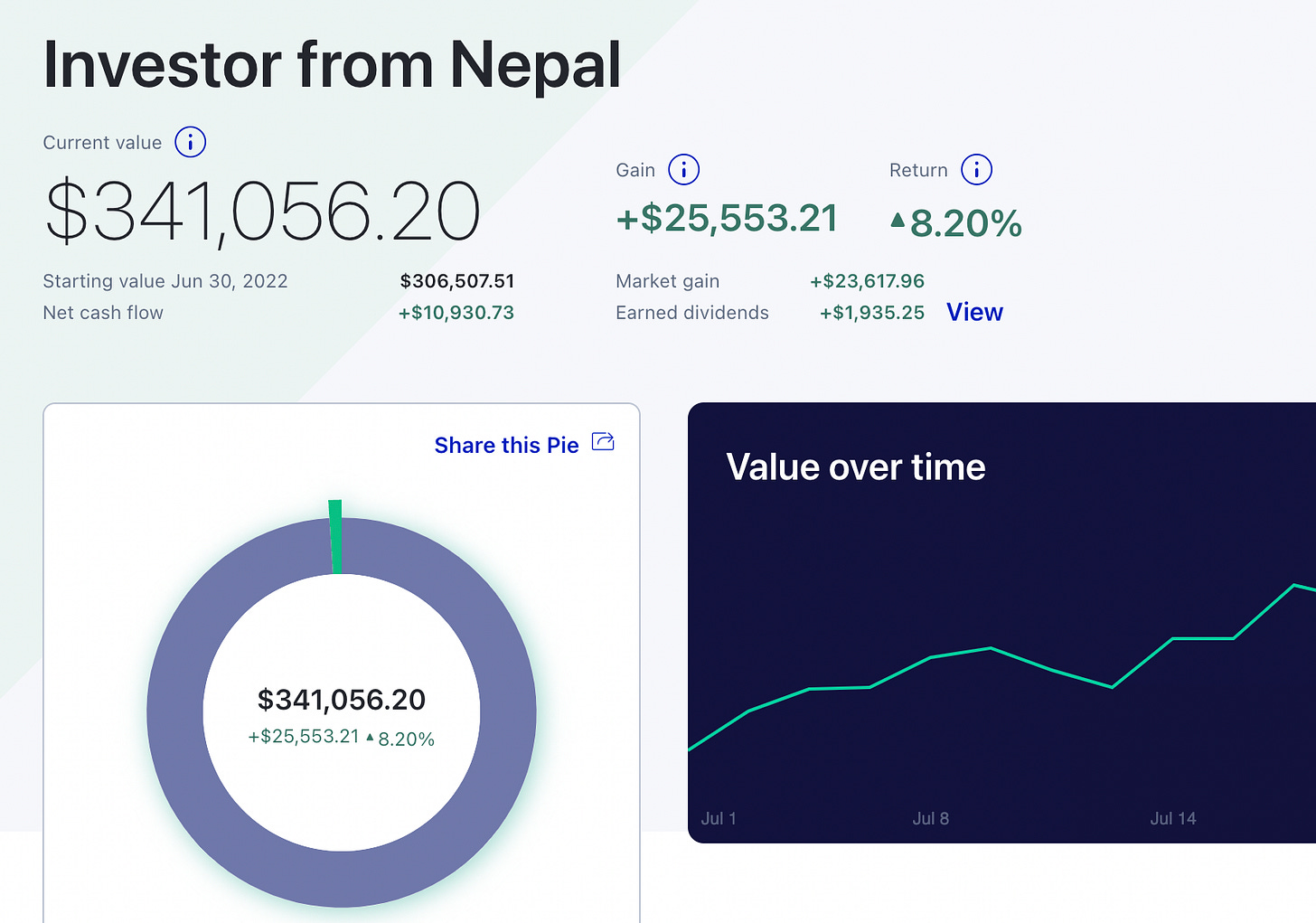

This month was an exciting month and was in greens (😮💨 feels like ages). My portfolio was up by 8.2%, while SP500 was in greens by 8.25%. 8.2% resulted in $25.5k taking the portfolio to the ATH again.

This month included 29 trades off which 2 were sales and 26 were purchases. I bought VOO 0.00%↑ 20 times with an average amount of $15 amounting to $300. I made a big purchase of U 0.00%↑ of $10,000 when Unity x IS was announced. I also exited out of 2 positions, BST 0.00%↑ and AGNC 0.00%↑ in total trade of $44,340.54. I made a purchase of CME 0.00%↑ with the sale of AGNC 0.00%↑, you can read about it here, and bought JEPI 0.00%↑ and QYLD 0.00%↑ with the trade of BST 0.00%↑. I reinvested dividends that I got from O 0.00%↑ to buy more O 0.00%↑, and bought some more JPM 0.00%↑ and VICI 0.00%↑ worth $300. Total trade was over $55k and the net invested amount was $10.9k.

Also, Commonstock has included new features in its profile section.

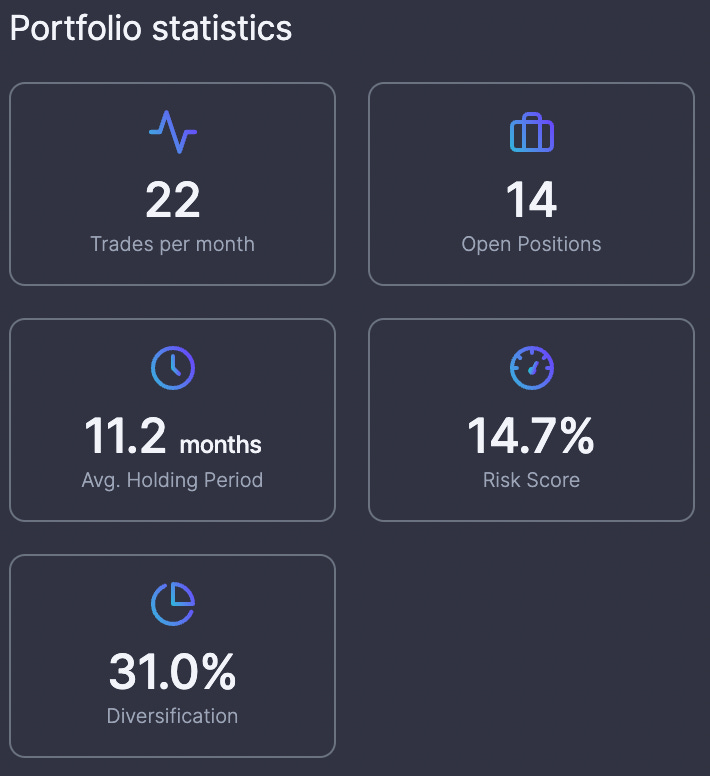

I exited out of BST 0.00%↑ so open positions are decreased to 14. The holding period has increased to 11.2 (ideally would like it to grow.). There are new scores, diversification, and risk score. While I don’t know how exactly both of them are calculated, I assume the lower the risk score the better it is, and the higher the diversification better it is. I’ll study more about it and write detail about it in my next post.

🍳 Private Equity update

I have always wanted to give back to society and invest in small-scale businesses. Ideally, I would have liked to invest in companies from Nepal. I have recently closed an investment with a social media company called Khal.com, this is the 4th that I have closed and can announce. You can check the entire portfolio here.

I also have 3 pending investments which will be announced soon. I generally invest in early-stage companies with validated ideas and experienced teams to execute the ideas. My cheque size ranges from $500 to $25,000 (can go higher if there is a strong product). If you know anyone who needs funding for their ideas please share this post with them or ask them to send the pitch deck to g@unicorn.games

🛫 Life events

Seems like Nepal is hit with flu season, I was on flu drugs for a week or two. I am close to closing two big investments and hope to announce them soon.

So, that’s all from this month. Over and out!